followers

298K

impressions

30.8M

likes

700K

comments

63.1K

posts

354

engagement

2.38%

emv

$869K

Avg. per post

97.6K

Key Metrics

monthly

Distributions

Content

5.46M

209K

4.73K

10mo ago

ericnomics

"We're going to win so much, you may even get tired of winning."

4.15M

117K

1.29K

10mo ago

ericnomics

Are Strippers the Ultimate Recession Indicator? 💸👠

The Stripper Index shows tip income drops when the economy slows

Discretionary spending—like strip clubs—is the first to get cut

Stripper Botticelli Bimbo calling the recession in 2022

While no official recession hit, the S&P 500 still dropped -18%

Other quirky indicators:

💄 Lipstick Index: Sales rise in tough times as people skip big luxuries

👗 Hemline Index: Skirts get shorter when the economy grows

3.65M

141K

3.15K

4mo ago

ericnomics

$2 trillion was wiped out in the stock market after President Trump announced an extra 100% tariff on China imports and export controls on critical software

This comes in retaliation of new export controls that China imposed on rare earth minerals.

This marks the worst day for stocks since April.

Over $19 billion was liquidated in the crypto markets marking the largest single day liquidation event for crypto's history

I believe this is an incredible buying opportunity for crypto.

Comment "CRYPTO" and i'll send you my referral to get a free $50 when you invest your first $100 on Gemini

1.04M

1.81K

321

9mo ago

ericnomics

With a Home Equity Investment from Hometap, you can access your home's equity without refinancing or taking on monthly payments.

Use the funds for anything:

🔧 Home improvements

💼 Starting a business

🎓 Life events

💳 Paying off high-interest debt.

Here’s how it works: Hometap gives you cash upfront in exchange for a share of your home’s future value with no monthly payments. You have up to 10 years to settle the investment with one payment. With over 18,000 homeowners funded and a 4.9-star rating on Trustpilot, Hometap is helping people unlock the power of their home equity

#NoMonthlyPayments #sponsored

919K

11.9K

8.53K

4mo ago

ericnomics

📉 Stocks will crash. It’s not “if,” it’s when.

Major US index is at all-time highs… but the data shows danger ahead:

⚠️ CAPE ratio → 25-year highs (only higher in the dot-com bubble)

⚠️ Buffett Indicator → Market is 2× GDP, record levels

⚠️ Forward P/E → Avg: 17 | Now: 22–30 👀

🔗 Want my playbook to protect yourself? Comment NEWS for my free newsletter.

📲 Want to see my full portfolio + real-time buy/sell alerts? Comment STOCK for the Blossom app.

👉 Share this with a friend who needs to hear the truth before it’s too late.

675K

336

161

6mo ago

ericnomics

Breaking down my crypto holdings and why the @paypal stablecoin PYUSD secured a permanent spot. I always keep some dry powder ready for the right opportunity, and PayPal offers 4% rewards for holding PYUSD. And when you’re ready, you can use it to buy more crypto, spend it, or send it globally #PayPalPartner

See paypal.com/cryptoterms for full details. PayPal, Inc. (NMLS #910457) is licensed to conduct virtual currency business activity by the New York State Department of Financial Services. Annual rate as of August 7, 2025 and subject to change. Rewards may not be available to NY-based users. Issuance of and custody of PayPal USD is performed by Paxos Trust Company, LLC

613K

2.98K

243

1mo ago

ericnomics

State of the market in 2026…

The S&P 500 gained over $600 billion in market today, rebounding after yesterday’s drop 📈

The index is now positive so far in 2026 💪

549K

4.7K

544

9mo ago

ericnomics

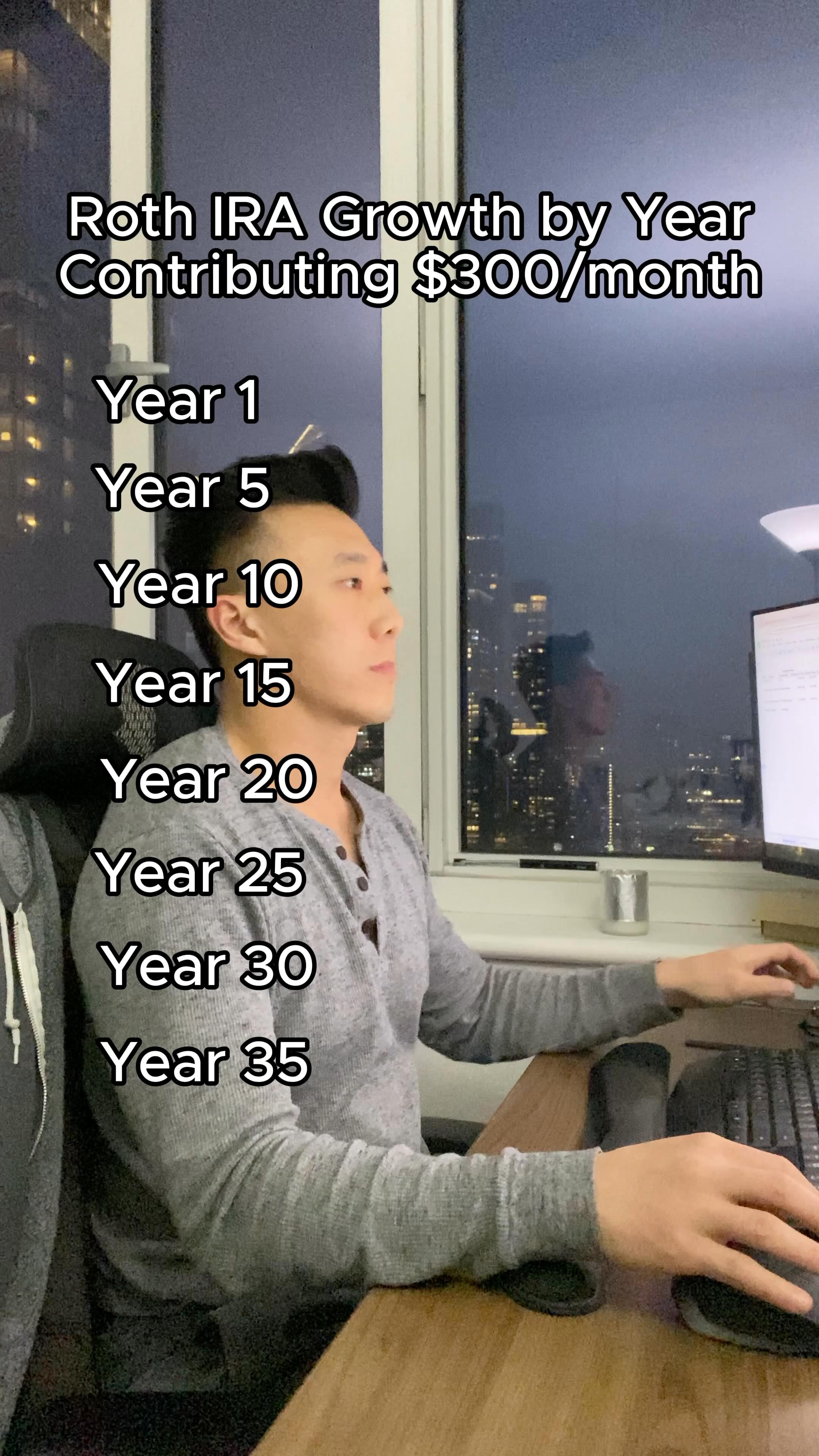

Roth IRA growth by year contributing $325/month* at 10% will make you a tax free millionaire.

Comment “STOCK” and I’ll DM you a link to see my entire portfolio and live trades

488K

7.41K

90

3mo ago

ericnomics

Whats the difference between QQQ vs QQQM?

Its the same index, holding and performance

There are 2 key differences

1. Expense

2. Liquidity

477K

3.71K

2.75K

1mo ago

ericnomics

JP Morgan’s list of top 47 stocks to buy in 2026

Here are the ones I like

#1 - Broadcom (AVGO)

#2 - Arista Networks (ANET)

#3 - Salesforce (CRM)

#4 - Palo Alto (PANW)

#4 - Alphabet (GOOGL)

Comment “LIST” to get the full list of 47 stocks to by in 2026 from JP Morgan and also to see all the stocks I hold myself

475K

5.19K

1.88K

1mo ago

ericnomics

🔥How to invest your first $1,000 in 2026🔥

🚀 Step 1: Open a reputable brokerage. Comment “START” for a list I recommend and any sign up bonuses

📈 $300: QQQM (Nasdaq 100 ETF) This serves as main growth driver as it mostly comprises of tech companies

💰 $250: VTI (Vanguard Total Stock Market ETF) for broad exposure with 3,500+ stocks.

🌎 $250: VXUS (Vanguard Total International Stock ETF) for geographical diversification

💸 $100: SCHD (Schwab US Dividend Equity ETF) for passive income paired with stability

🌐 $100: IBIT & ETHA (Bitcoin & Ethereum ETFs) for high risk, high-reward potential

🙌 2026 if YOUR year for wealth. Take action now!

441K

3.94K

124

1mo ago

ericnomics

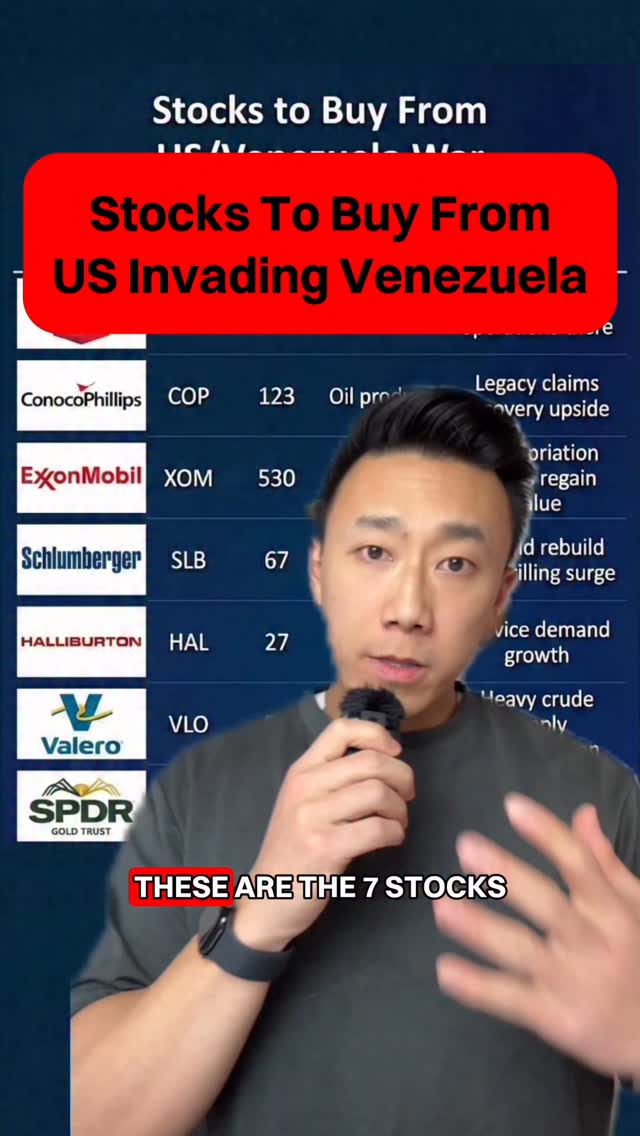

7 stocks that stand to benefit from US/Venezuela conflict

1. Chevron (CVX)

2. ConocoPhillips (COP)

3. Exxon Mobil (XOM)

4. SLB (SLB)

5. Halliburton (HAL)

6. Valero (VLO)

7. SPDR Gold Trust (GLD)

384K

5.33K

3.24K

2w ago

ericnomics

🚨 Bitcoin is crashing and it could drop another 20%… and I’m actually hoping it does

👀 Here are 3 things I’m watching closely

⚡ Bitcoin has never stayed below what it costs to mine it (aka electrical cost)

🛑 If miners lose money, they shut off their machines — simple as that

📊 Historically, when price dips below production cost, it’s been an insane buying opportunity

🔥 If Bitcoin drops into the production cost zone, I’m buying aggressively

🚚 If Bitcoin drops to electrical cost, I’m backing up the truck

🏦 I’ve been parking cash in my NOOK account earning up to 7.6%, ready to deploy

👇 Want this too? Comment NOOK and I’ll send it to you

🎁 Want free money & welcome bonuses to buy crypto?

👇 Comment BONUS and I’ll send them over

📌 Save this and send it to a friend who needs to see it — this could genuinely change lives

⚠️ Not financial advice — just what I’m personally doing. Be smart. Be responsible.

373K

7.87K

487

4w ago

ericnomics

Silver is having an historic start to 2026, up 38% and on track for its best month since 1970 😳

It hit another all-time high today, alongside Gold 👀

Would you rather hold Gold, Silver, or the S&P 500 for 2026?

321K

10K

201

9mo ago

ericnomics

These are 12 foods everyone should stock up on before tariffs increase their price according to allrecipe

321K

2.33K

611

3mo ago

ericnomics

3 ETFs to hold for life

#1 - VTI Vanguard Total Stock Market ETF. This gives entire US market exposure across size large, mid, small, value and growth

#2 - QQQM Nasdaq 100 ETF. This will be main growth driver as its heavy on high growth tech companies

#3 - VXUS Vanguard Total International Stock ETF. It gives broad exposure outside the US to both developed and emerging markets

Bonus: IBIT iShares Bitcoin ETF. I believe this will outperform all of them in the next decade

Comment “STOCK” to see my entire portfolio

Let me know what you think. Which is your favorite? Did I miss any?

279K

11.2K

104

2w ago

ericnomics

What a day…

The Dow Jones hit a new record high, passing 50,000 for the first time, and the S&P 500 gained over $1 TRILLION in market cap 📈

Nvidia has its best day since April 2025, gaining over $300 billion in market cap. Don’t forget, Nvidia makes up around 8% of the entire S&P 500 👀

Bitcoin had a big rebound, jumping 16% in the past 24 hours, but It’s still down ~30% from its all-time high

What will Monday bring?

Remember, always follow the data…

253K

2.1K

46

2mo ago

ericnomics

Public just changed the game by letting you create your own index with their new AI investing tool, Generated Assets. Whatever you can imagine can be made into a custom index with a single prompt no matter how easy or complex it is.

I tried it with “chip companies with growing revenues of 10% year over year with analyst buy rating” and it made a custom index with backtested results against the S&P500.

Check it out for yourself at @publicapp

237K

9.48K

83

2w ago

ericnomics

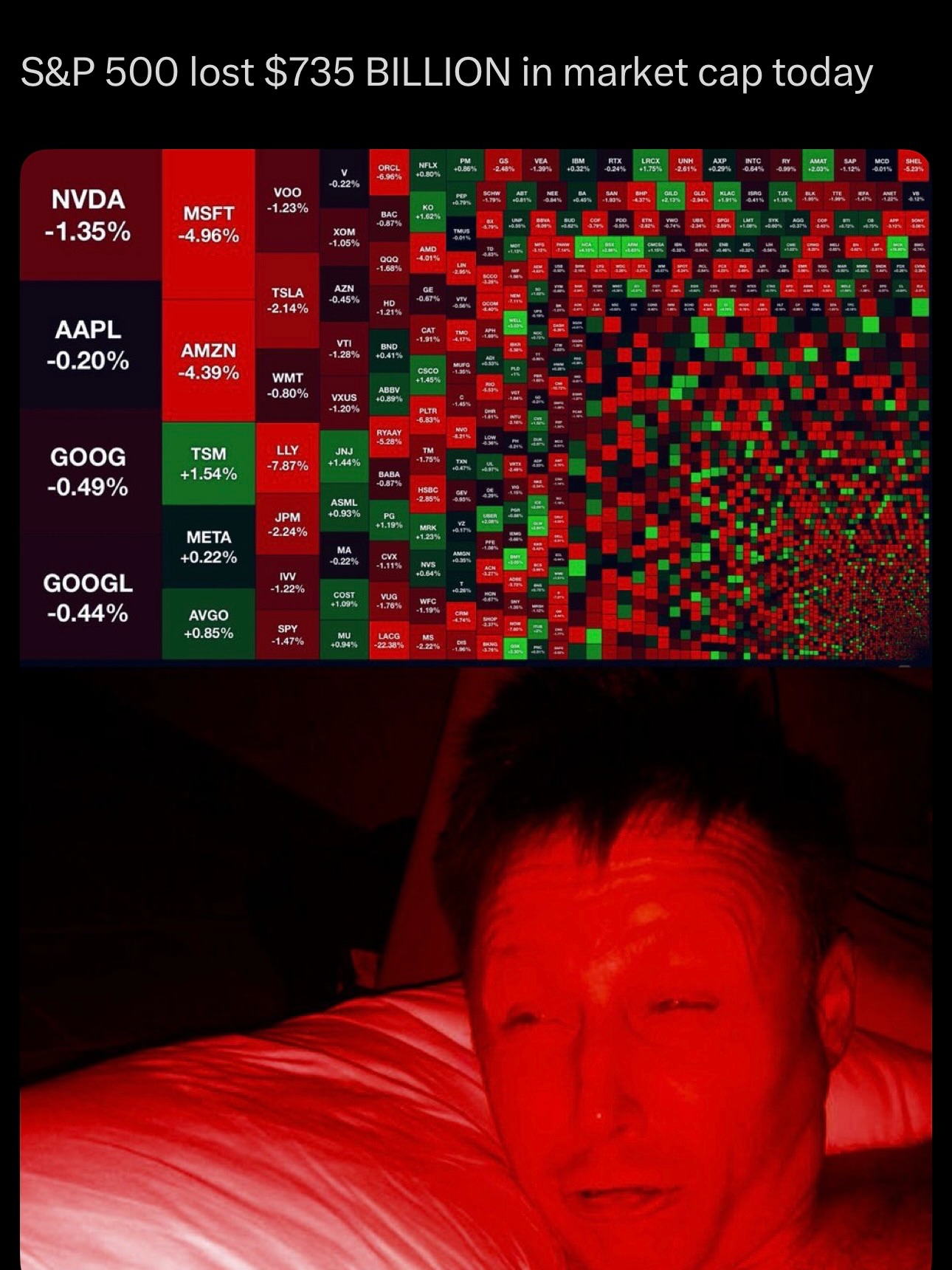

BREAKING: The stock market…

The S&P 500 lost $735 BILLION in market cap today, as volatility is in full swing. The index is now down 0.6% YTD 😳

Bitcoin is leading the plunge, now at its lowest level since October / November 2024. Just in 2026, Bitcoin is down 27% and Ethereum is down 38% 📉

Big tech is taking the biggest losses, with Microsoft on pace for its worst start to a year since 2000. Throwback Thursday?

What will tomorrow bring?

230K

2.25K

1.86K

10mo ago

ericnomics

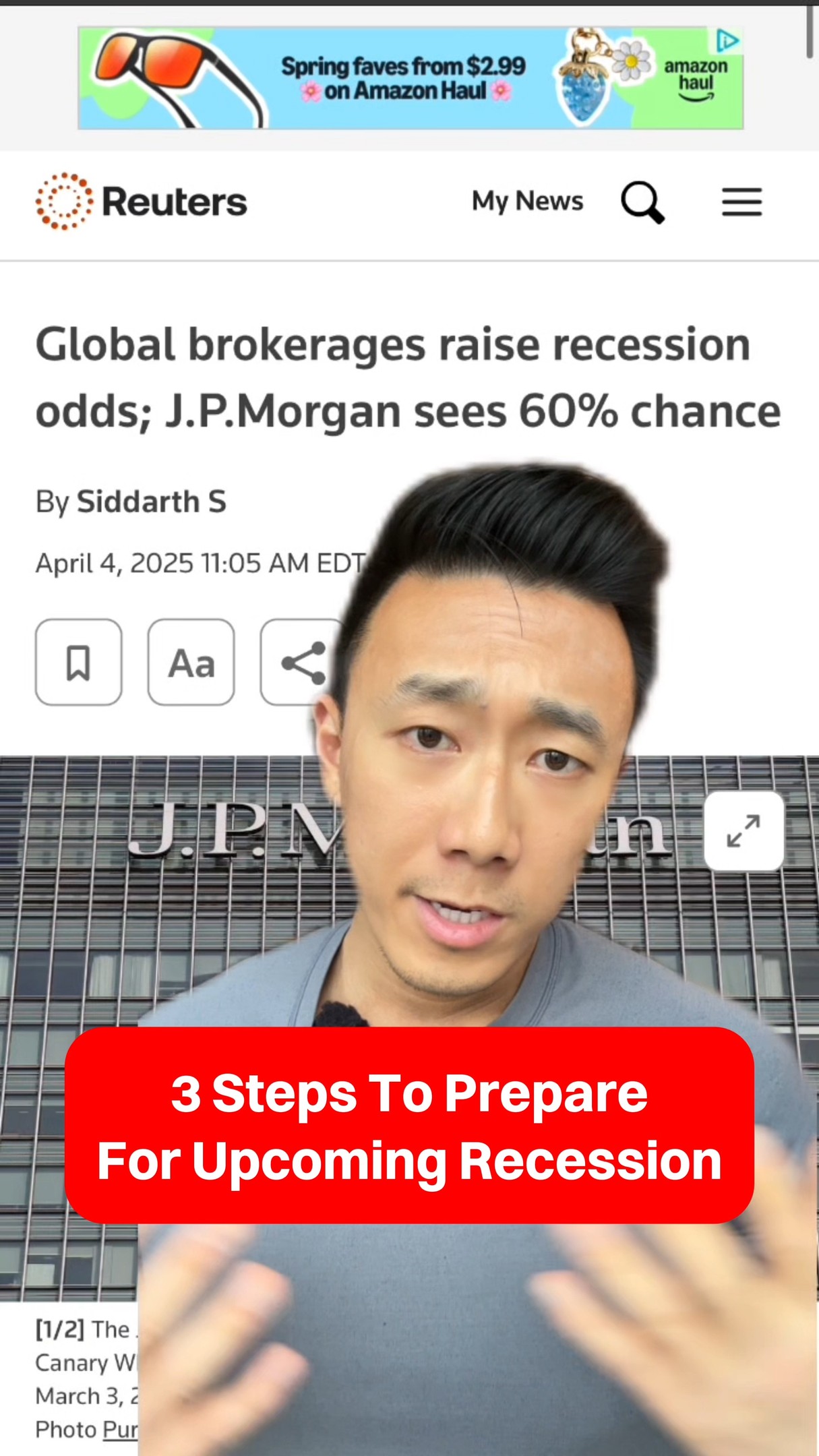

🚨 JP Morgan just raised the odds of a recession to 60% – up from 40% just days ago. Whether you believe a recession is coming or not, there are steps you can take right now to protect yourself financially.

In this video, I break down 3 smart money moves you can control to stay ahead, no matter what happens:

1️⃣ Car Insurance: It’s the #1 inflation category – higher than rent or food. Use the free tool in my bio to shop and compare quotes. It could save you hundreds. Comment CAR and I’ll send it to you.

2️⃣ High-Yield Savings: Your savings should be working for you. I’ve got a list of high-yield savings accounts paying 4%+ – safe, easy, and what I personally use. Comment BANK or check the link in bio.

3️⃣ Watch Your Spending: No job is 100% secure anymore – not even government jobs. Budget like your future depends on it, because it just might.

If you found this helpful, give it a like and send it to someone who needs to see this. It costs you nothing but could make a big difference for someone else 🙏

#recession #moneymoves #personalfinance #inflation #budgeting #savemoney #highyieldsavings #carinsurance #financialtips #jpmorgan #recessionproof

Eric Pan (@ericnomics) Instagram Stats & Analytics

Eric Pan (@ericnomics) has 298K Instagram followers with a 2.38% engagement rate over the past 12 months. Across 354 posts, Eric Pan received 700K total likes and 29M impressions, averaging 2.22K likes per post. This page tracks Eric Pan's performance metrics, top content, and engagement trends — updated daily.

Eric Pan (@ericnomics) Instagram Analytics FAQ

How many Instagram followers does Eric Pan have?+

Eric Pan (@ericnomics) has 298K Instagram followers as of February 2026.

What is Eric Pan's Instagram engagement rate?+

Eric Pan's Instagram engagement rate is 2.38% over the last 12 months, based on 354 posts.

How many likes does Eric Pan get on Instagram?+

Eric Pan received 700K total likes across 354 posts in the last year, averaging 2.22K likes per post.

How many Instagram impressions does Eric Pan get?+

Eric Pan's Instagram content generated 29M total impressions over the last 12 months.