followers

202K

impressions

5.16M

likes

90.9K

comments

4.13K

posts

99

engagement

1.65%

emv

$131K

Avg. per post

52.7K

Key Metrics

monthly

Distributions

Content

1.23M

16.8K

336

4mo ago

stephandden

Here’s how much I spent on an engagement ring for my now fiancée 💍

➡️ Ring Details: Lab-grown oval diamond, 2.5 carats, 2.1mm gold band with platinum prongs, diamond gallery rail

➡️ Jeweller: @liviadiamonds

➡️ Total Cost: $4,476 CAD

Note: We’re sharing how much we spent for transparency purposes - not because we think that you (or anyone) should spend the same amount! We spent our 20’s prioritizing our money goals and long-term investments first, before spending money on this.

How much did you (or do you plan to) spend on an engagement ring? Let us know! 👀

#EngagementRing #EngagementRingDetails #EngagementRingCost #EngagementRingPrice #Engaged #ProposalExpenses #ProposalStory #ProposalStoryTime #EngagementExpenses #CostOfEngagement

546K

20.6K

62

7mo ago

stephandden

Who spent more money in June? 👀

We both track all of our spending every single month, so we can see how much money we spent overall and per category.

*Note: This only includes our variable expenses - we split our fixed expenses 50/50, so there’s nothing to ‘compare’.

This month, Dennis spent more money for the second month in a row, mostly because of that high car rental cost (he drove his mom to a few appointments this month!). Otherwise, we both had a pretty ‘on-budget’ month!

What was your highest expense category this month? Let us know! 😊

#PersonalFinance #MoneyTips #HowToSaveMoney #HowMuchISpent #SpendingMoney #MonthlyBudget #AnnualBudget #HowMuchISpentThisMonth #ISpentTooMuchMoney #HowIBudget #MyBudget #BudgetingTips #WhatISpendInAMonth #HowMuchISpentInJune #JuneWhatISpent

511K

888

18

4mo ago

stephandden

Why we choose to invest in ETFs 👀

ETFs (aka Exchange Traded Funds) allow you to invest in thousands of different stocks, and/or other investment options, by purchasing one single fund.

ETFs provide a low-cost, simple investment option. 👏🏿👏🏻

BMO ETFs is a large, established and trusted Canadian provider, and they were actually the first bank to offer ETFs in Canada. They know and understand the Canadian investor through 16+ years of ETF experience.

You can buy BMO ETFs (like ZEQT) through any self-directed online platforms!

Invest with the power of BMO ETFs - learn more at bmoetfs.com

#BMOETFs #BMOGAM #ETFs

#ad This video is sponsored by BMO ETFs. Steph & Den is compensated under this arrangement by BMO ETFs. Please watch the video for the full disclaimer.

Commissions, management fees and expenses all may be associated with investments in exchange traded funds. Please read the ETF Facts or prospectus of the BMO ETFs before investing. Exchange traded funds are not guaranteed, their values change frequently and past performance may not be repeated. For a summary of the risks of an investment in the BMO ETFs, please see the specific risks set out in the BMO ETF’s prospectus. BMO ETFs trade like stocks, fluctuate in market value and may trade at a discount to their net asset value, which may increase the risk of loss. Distributions are not guaranteed and are subject to change and/or elimination. BMO ETFs are managed by BMO Asset Management Inc., which is an investment fund manager and a portfolio manager, and a separate legal entity from Bank of Montreal.

This video is for information purposes only and does not provide investment advice or recommendations. The information contained herein is not, and should not be construed as, investment, tax or legal advice to any party. Particular investments and/or trading strategies should be evaluated relative to the individual’s investment objectives and professional advice should be obtained with respect to any circumstance.

“BMO (M-bar roundel symbol)” is a registered trademark of Bank of Montreal, used under licence.

422K

757

20

7mo ago

stephandden

Save energy this summer by enrolling in the Peak Perks program! ☀️💨

The @saveonenergy Peak Perks program is an easy way to manage your electricity use and help out the grid during the hottest months of the year.

If you have a smart thermostat, you’ll get a $75 virtual prepaid MasterCard when you enroll and an additional $20 each year you stay enrolled in the program.

Here’s how it works -

➡️ Between June and September, Peak Perks makes small, time-limited, automatic adjustments to your home’s temperature when demand for electricity is high

➡️ Adjustments take place only on weekdays, and only for up to 3 hours

➡️ The max adjustment is just 2 degrees Celsius

➡️ You’re always in control, and you can opt out at any time

By participating in the Peak Perks program, you’re helping keep the grid more reliable for everyone! 250,000+ people are already participating.

You’re eligible to participate if you live in Ontario and have either central A/C or an eligible smart thermostat.

You can enroll and learn more at peakperks.ca

#ad #PeakPerks #SaveonEnergy #PersonalFinance #Money #MoneyTips #HowToSaveMoney #MoneySavingTips #SavingMoney #SaveMoneyOnElectricity #OffPeakHours #ElectricBill #HydroBill

187K

7.49K

396

4mo ago

stephandden

08.25.2025 💍

📷: @sincerelystudio

177K

3.91K

82

4mo ago

stephandden

How much I spent on a surprise proposal 👀💍

I know that I went a little all out on this, but I really wanted to do something special. Having a photographer was definitely a must for me and Steph - to us, photos are really important and very sentimental, and I knew that if we had a photographer, all we would need to focus on was each other!

Here’s the cost breakdown -

➡️ Hotel - $1,255.11

➡️ Rental Car - $285.18

➡️ Gas - $57.18

➡️ Photographer - $847.50

➡️ Meals & Drinks - $524.78

➡️ TOTAL - $2,969.75

We’ll share more about the engagement ring (and of course how much it cost) soon!

#ProposalExpenses #ProposalStory #ProposalStoryTime #EngagementExpenses #CostOfEngagement #EngagementRing #Engaged

109K

1.08K

319

5mo ago

stephandden

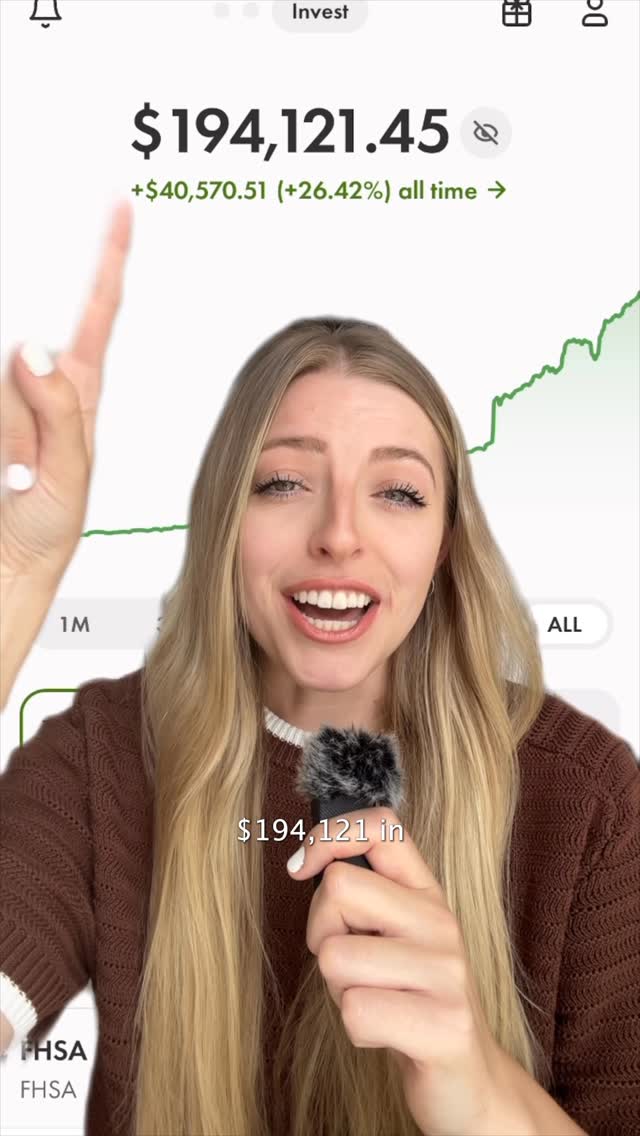

I currently have $194,121.45 in my investment accounts 💰

Here’s the breakdown by account -

➡️ TFSA - $76,500 invested, $99,166.50 current value

➡️ RRSP - $61,985 invested, $72,015.97 current value

➡️ FHSA - $16,000 invested, $18,787.41 current value

➡️ Taxable - $4,015 invested, $4,141.58 current value

If you want to learn how YOU can start investing in the stock market, comment ‘INVEST’ to get the registration link to our free investing workshop.

We have a few sessions available - each one will start with the workshop, and end with a Q&A where we’ll answer all of your money and investing questions.

➡️ Tuesday, September 2, 2025 @ 8:00pm EST

➡️ Wednesday, September 3, 2025 @ 8:00pm EST

➡️ Thursday, September 4, 2025 @ 8:00pm EST

See you there! 🤑

#PersonalFinance #Money #MoneyTips #HowToInvest #Invest #Investing #InvestingMoney #InvestMoney #HowToInvestForBeginners #InvestingForBeginners #InvestmentTips #StockMarket #StockMarketInvesting

104K

306

7

3mo ago

stephandden

Three lessons we’ve learned about saving for retirement from our family 💡

1️⃣ It’s important to start early

2️⃣ Retirement isn’t an age, it’s an amount of money

3️⃣ The CPP Fund is a foundation for your retirement income

The CPP - Canada Pension Plan - helps build a foundation for your retirement. It’s intended to replace part of your income when you retire.

The CPP Fund is managed by CPP Investments, an independent professional investment organization that has been investing the CPP Fund since 1997. CPP Investments recently released the results of their annual retirement survey, offering key insights into Canadians’ attitudes toward retirement readiness and financial security.

To learn more about @CPPInvestments, and see their recent retirement survey results, check out their website - cppinvestments.com/for-canadians/

#CPP #CanadaPensionPlan #CPPInvestments #Retirement #SavingForRetirement #HowToRetire #RetirementPlanning #RetirementPlan #RetirementTips

82K

2.09K

16

6mo ago

stephandden

Who spent more money in July? 😊

We both track all of our spending every single month, so we can see how much money we spent overall and per category.

*Note: This only includes our variable expenses - we split our fixed expenses 50/50, so there’s nothing to ‘compare’.

This month, Steph spent more money (but only by a little bit!). We’ll see how next month goes…

What was your highest expense category this month? Let us know! 👀

#PersonalFinance #MoneyTips #HowToSaveMoney #HowMuchISpent #SpendingMoney #MonthlyBudget #AnnualBudget #HowMuchISpentThisMonth #ISpentTooMuchMoney #HowIBudget #MyBudget #BudgetingTips #WhatISpendInAMonth #HowMuchISpentInJuly #JulyWhatISpent

81.5K

2.06K

16

5mo ago

stephandden

Who spent more money in August? 👀

We both track all of our spending every single month, so we can see how much money we spent overall and per category.

*Note: This only includes our variable expenses - we split our fixed expenses 50/50, so there’s nothing to ‘compare’.

This month, Steph spent more money (it was an over budget month!), but we’ll have to see what happens in September!

What was your highest expense category this month? Let us know! 👀

#PersonalFinance #MoneyTips #HowToSaveMoney #HowMuchISpent #SpendingMoney #MonthlyBudget #AnnualBudget #HowMuchISpentThisMonth #ISpentTooMuchMoney #HowIBudget #MyBudget #BudgetingTips #WhatISpendInAMonth #HowMuchISpentInAugust #AugustWhatISpent

79.6K

1.05K

217

10mo ago

stephandden

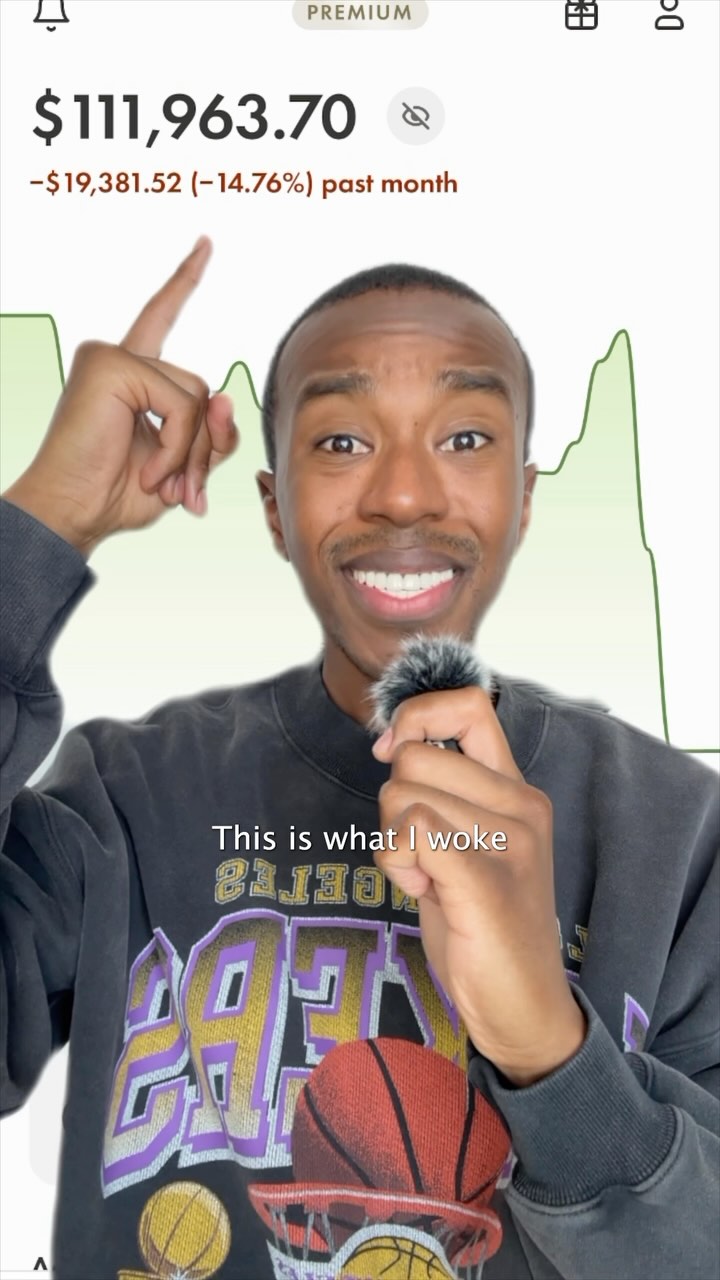

The stock market is crashing... 😳‼️

... but here’s why I’m not panicking.

I’m a long-term, passive investor - that means that I invest in ETFs that track the global stock market (aka I purchase funds that include stocks from markets all over the world, not just in the US), and I plan on continuing to invest in these funds for multiple decades.

The idea behind passive investing is that you invest when the market is up, and doing well, and when it’s down, and not doing so well (like right now!) - then, historically, you end up with a strong average return over the long-term.

So, right now - from an investing stand point - is just another one of the many dips we’ll see over a long period of time.

That means that I’m 1) not panicking, 2) not selling my investments, and 3) not pausing my investments - instead, I’m continuing to purchase investments as I usually would (aka investing a set amount every month, and additional lump sums whenever I have the money).

If you want to learn more, comment INVEST to get the registration link to our free investing workshop where we’ll break down how you can start investing in the stock market.

We have a few sessions available - each one will start with the workshop, and end with a Q&A where we’ll answer all of your money and investing questions.

➡️ Tuesday, April 22, 2025 @ 8:00pm EST

➡️ Wednesday, April 23, 2025 @ 8:00pm EST

➡️ Saturday, April 26, 2025 @ 1:00pm EST

#PersonalFinance #Money #MoneyTips #HowToInvest #Invest #Investing #InvestingMoney #InvestMoney #HowToInvestForBeginners #InvestingForBeginners #InvestmentTips #StockMarket #StockMarketCrash #StockMarketCrashing #MarketCrash #Tariffs

58.2K

1.45K

36

8mo ago

stephandden

Why do we still rent a tiny ‘1 bedroom’ apartment when we have over $300,000 in the bank? 👀

We have a great rent price for an expensive city like Toronto (right now it’s $1,980/month, which we split between the two of us).

We purposely chose a place on the low end of our budget when we moved in 7 years ago, and it was also a rent-controlled building…

…which means that the annual price increases are capped at a set rate (and our landlord gratefully didn’t increase our rent for ~4 years!).

If we were to move, we’d be spending A LOT more money per month.

Which we don’t want right now!

We want to keep our fixed expenses low, so we can save and invest as much money as possible while we’re young.

A bigger space would be nice, sure, but having thousands of extra dollars in the bank for our future selves is better.

One day we’ll buy a house, but for now - while we still live in the city - it’s this tiny little box for us. 😌

This series was inspired by @alexonabudget (especially this video topic - we related to it heavy!) - go check out her page! 🫶🏻

#20MoneyLessons #LastYearOfMy20s #PersonalFinance #MoneyTips #Money #MoneyGoals #FinancialGoals #SavingMoney #HowToSaveMoney #RentingvsBuying #RentvsBuy #RentvsBuyAHouse #RentingvsBuyingAHouse

49.7K

647

23

9mo ago

stephandden

My investment portfolio results 🫢

I’ve been investing on my own, taking a DIY approach for 1.5 years…

…before that, I used a robo-advisor for about 3 years!

Robo-Advisor = invests for you; you sign up, pick your risk level, fund your investment account with money, and an algorithm chooses your investments, purchases them for you and rebalances them consistently.

DIY Approach = you invest yourself; you sign up, fund your investment account with money, and you decide exactly what investments you want to purchase and do the purchasing yourself.

When I switched to DIY investing, the biggest decision I had to make was what investments I wanted to purchase, and I decided to invest in 2 ETFs that are both globally diversified and made up of 100% stocks.

I also have 3 different investment accounts, and here’s the breakdown -

➡️ TFSA - $76,500 invested, $92,698 current value

➡️ RRSP - $60,000 invested, $65,424 current value

➡️ FHSA - $16,000 invested, $17,571 current value

Keep in mind that these are my current, short-term returns - my goal is to have a strong long-term return, decades from now!

What are you investing in right now? Let us know! 👀

#PersonalFinance #Money #MoneyTips #HowToInvest #Invest #Investing #InvestingMoney #InvestMoney #HowToInvestForBeginners #InvestingForBeginners #InvestmentTips #StockMarket #GlobalStockMarket #GlobalDiversification #SP500 #GeographicDiversification #Stocks #StockMarketInvesting #ETFs #Funds

43.7K

1.12K

47

7mo ago

stephandden

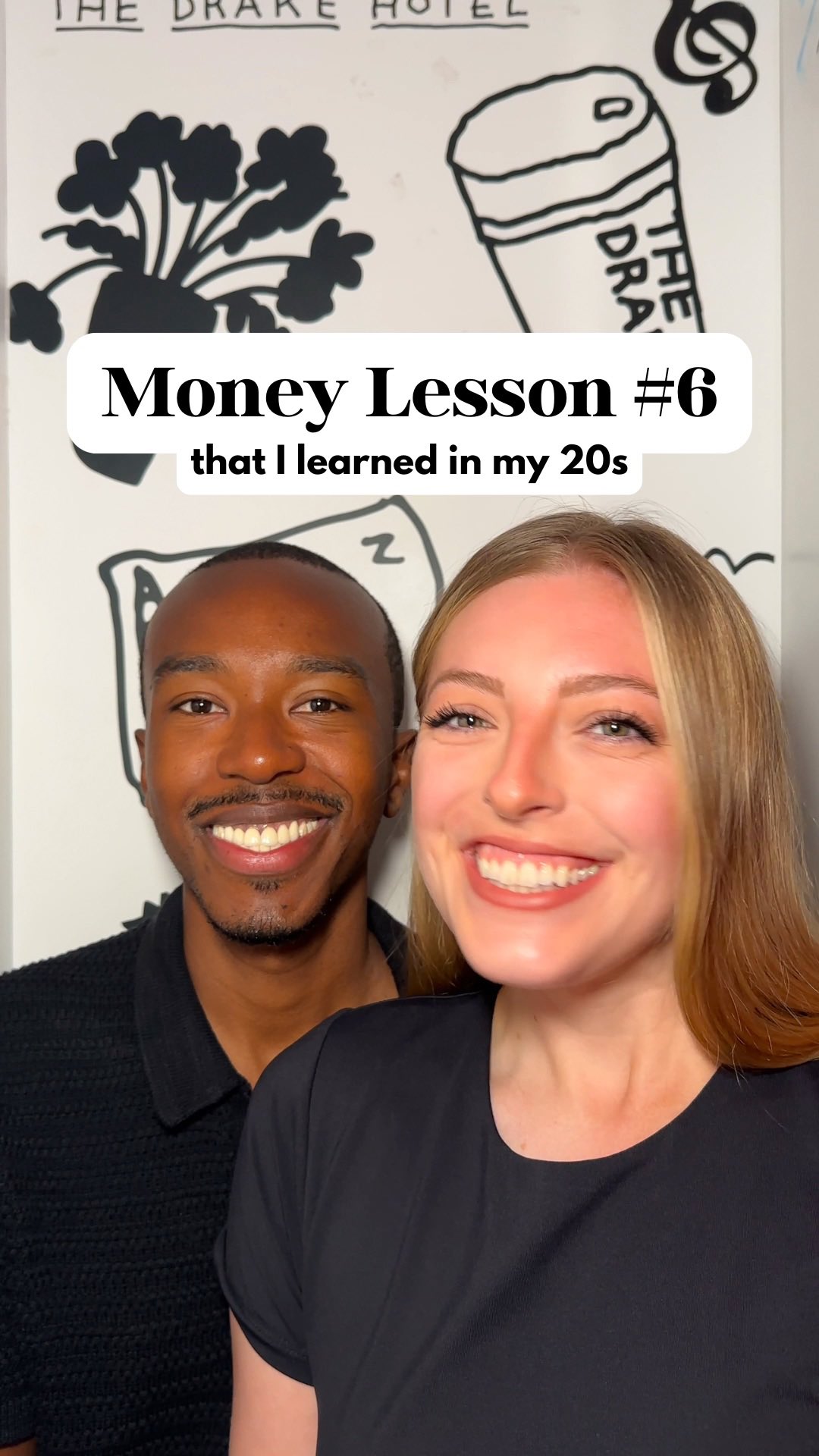

Someone else’s timeline doesn’t have to be yours 💍

(But we are excited for the next step…!) 👀

#20MoneyLessons #LastYearOfMy20s #PersonalFinance #MoneyTips #Money #MoneyGoals #FinancialGoals #SavingMoney #HowToSaveMoney #MoneyForCouples #MoneyInRelationships #CouplesMoney

43.4K

1.74K

85

10mo ago

stephandden

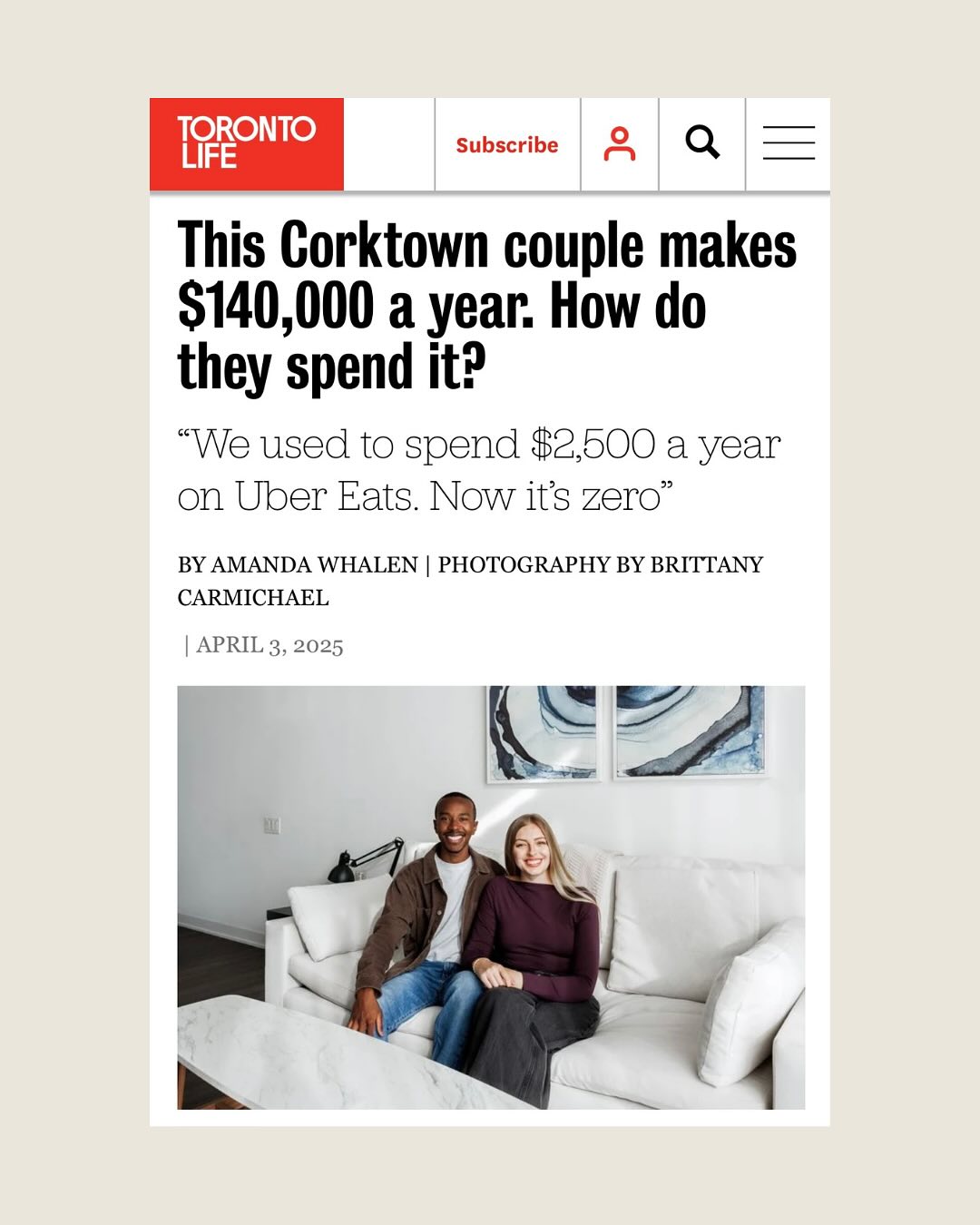

We were featured in Toronto Life! 👀 @torontolife

We’re so excited to share this article - we were interviewed for Toronto Life’s ‘Cost Of Living’ section, where a person (or a couple) shares their finances.

We break down our spending - and investing - all of the time, so this was right up our alley!

Financial transparency is really important to us - our goal is to share real life examples of an individual’s (and a couple’s!) money journey.

If you’ve been following along for the past couple of years, you’ve seen us hit so many money milestones, from Dennis paying off $50,000 of student loan debt, to us both hitting a $100,000+ net worth, to growing our investment portfolios to the six figure mark, and more. We can’t wait to share more updates with you, and take you along on the journey, over the years ahead!

Make sure you check out the article to hear more about our typical monthly spending, and a big thank you to Amanda Whalen and Brittany Carmichael for working with us on this feature!

🙏🏿🙏🏻

38.4K

1.54K

106

5mo ago

stephandden

I officially turned 30 years old last week 🥲

I’m not gonna lie… 30 feels like a big one! But I’m so grateful to be another year older, and for everything that my 20s brought me.

My 20s taught me to follow my dreams, that hard work pays off (even if it happens slower than you want it to!), and that life’s really all about community.

There’s still so many things that I’m looking forward to over the next few years, like -

✔️ Hosting live events for our community 🎙️

✔️ Seeing more of the world 🌍

✔️ Hitting $500k invested (and beyond!) 💰

✔️ Growing my relationship 🫶🏿

✔️ Launching something new… 👀

Thank you to everyone who’s been along on the journey - believe it or not, we’re just getting started! 🙏🏿

36.4K

1.89K

82

4mo ago

stephandden

We’re officially fiancé(e)s! 🤭

As always, we’re going to be sharing all of the costs involved in 1) the proposal, 2) the engagement ring, and 3) anything wedding related, but first we wanted to give a little recap of the proposal itself.

We had so much fun on our ‘getaway’, and we’re so excited to be engaged! Also, thank you so much to everyone for your love and congratulations message, we really appreciate it. 🙏🏿🙏🏻

Btw - don’t worry, our usual money content isn’t going anywhere (this is just a very short intermission).

#Proposal #ProposalStory #ProposalStoryTime #Engagement #EngagementRing #Engaged

35.2K

564

17

11mo ago

stephandden

Here’s what I spent last month as a 28 year old who lives in Toronto 😅

February was another high spending month for me - I’m starting the year on the high side, which I expect to start going down next month!

➡️ Rent - $970.00 (my half)

➡️ Utilities - $24.29 (my half)

➡️ Internet - $36.72 (my half)

➡️ Groceries - $431.89 (my half)

➡️ Restaurants - $136.90

➡️ Coffee Shops - $20.03

➡️ Home - $954.44

➡️ Gifts / Donations - $795.67

➡️ Massage - $146.90

➡️ Personal Care - $130.10

➡️ Transportation - $127.60

➡️ Subscriptions - $14.34

➡️ Investments - $2,000.00

➡️ Total - $5,788.88

How much money did you spend in February? Let us know - and remember that our free budget tracker is always linked in our bio! 💰

#PersonalFinance #MoneyTips #Money #WhatISpendInAMonth #HowMuchISpentInFebruary #HowMuchMoneyISpend #SpendingMoney #FebruaryBudgetWithMe #PayDayRoutine #PayDay #PayCheck #PayCheckBreakDown #BudgetMyPayCheck #SalaryTransparency #IncomeTransparency #FinancialTransparency #Income #Budget #Budgeting #MonthlyBudget #BudgetWithMe #BudgetRoutine

34.6K

307

8

3w ago

stephandden

We made a Wealthsimple Household ✨

We have a big combined net worth goal this year, so having our combined net worth visible at the top of our investment platform dashboard is perfect!

If you want to start using Wealthsimple, you can use our link (find it in our bio!) and get a $25 sign up bonus. 💰

#Investing #HowToInvest #HowToInvestForBeginners #StockMarket #StockMarketInvesting

32K

540

11

10mo ago

stephandden

Here’s what I spent last month as a 28 year old who lives in Toronto 🥰

This month was a pretty standard one for me - I was under budget overall, so I’ll take that as a win!

➡️ Rent - $970.00 (my half)

➡️ Utilities - $31.20 (my half)

➡️ Internet - $36.72 (my half)

➡️ Groceries - $407.95 (my half)

➡️ Restaurants - $182.85

➡️ Coffee Shops - $55.22

➡️ Gifts / Donations - $4.52

➡️ Massage - $146.90

➡️ Clothing - $180.80

➡️ Transportation - $107.02

➡️ Fitness - $134.47

➡️ Other - $23.73

➡️ Subscriptions - $29.02

➡️ Investments - $2,000.00

➡️ Total - $4,310.40

How much money did you spend in March? Let us know!! 💰

#PersonalFinance #MoneyTips #Money #WhatISpendInAMonth #HowMuchISpentInMarch #HowMuchMoneyISpend #SpendingMoney #MarchBudgetWithMe #PayDayRoutine #PayDay #PayCheck #PayCheckBreakDown #BudgetMyPayCheck #SalaryTransparency #IncomeTransparency #FinancialTransparency #Income #Budget #Budgeting #MonthlyBudget #BudgetWithMe #BudgetRoutine

Steph & Den (@stephandden) Instagram Stats & Analytics

Steph & Den (@stephandden) has 202K Instagram followers with a 1.65% engagement rate over the past 12 months. Across 99 posts, Steph & Den received 90.9K total likes and 4.78M impressions, averaging 927 likes per post. This page tracks Steph & Den's performance metrics, top content, and engagement trends — updated daily.

Steph & Den (@stephandden) Instagram Analytics FAQ

How many Instagram followers does Steph & Den have?+

Steph & Den (@stephandden) has 202K Instagram followers as of February 2026.

What is Steph & Den's Instagram engagement rate?+

Steph & Den's Instagram engagement rate is 1.65% over the last 12 months, based on 99 posts.

How many likes does Steph & Den get on Instagram?+

Steph & Den received 90.9K total likes across 99 posts in the last year, averaging 927 likes per post.

How many Instagram impressions does Steph & Den get?+

Steph & Den's Instagram content generated 4.78M total impressions over the last 12 months.