Key Metrics

Distributions

I personally know dozens of people who would move in 2026 if they could take their 2.75% 30YR Mortgage and apply it to the next home.

Selling my wonderful 2020 Tesla Model X for $35,000 😎

Here’s a free 30-day trial to Prime for anyone interested - no Bikinis, I promise 😂 amazon.com/gp/video/detail/B0G2RVNJMC

@lucawashenko Reach out to any criminal fraud department / file FBI IC3 Report. Wire recall immediately. Escalate as fast as possible. If you don’t reverse this asap, it’ll be impossible to get back - especially with a holiday / weekend.

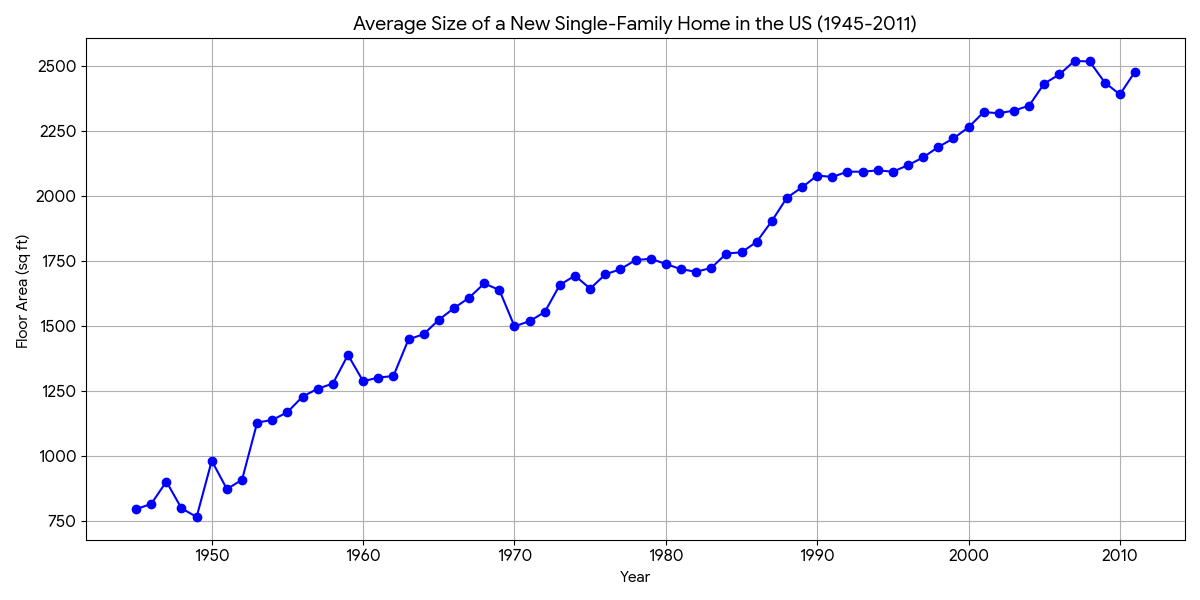

A 50-Year Mortgage would allow you to buy approximately 10% more house (or save about 10%) at the expense of nearly DOUBLING your payment schedule. There's no way that ends well. A 50-year mortgage isn't worth it and won't add much benefit since your mortgage interest is front-loaded. Homeowners will have very little, if any equity by the time they sell (homeowners keep their home an average of 11.8 years). It sounds good on paper, but financially, it makes very little sense. Instead, here's what would make a real difference: 1. Increase capital gains exclusion to $1M married filing jointly, and increase it every year with CPI. This will incentivize more sellers to finally let go of their home. 2. Allow you to take your existing mortgage with you to the next home, as long as you're "Trading Up," opening up lower-priced inventory. 3. Allow people to write off the first $1.5M worth of mortgage interest, instead of $750,000, for new mortgages as of 2026. This would help unlock way more inventory. Follow for more random thoughts.

Me: Read this file and summarize it. ChatGPT: You’re working too hard, take a break with this special offer from Southwest Airlines to visit a Disney Resort! Offer valid February 1-15th. Me: No, read this document and summarize it. ChatGPT: You’re right! But while I read your document, get 15% off your next McDonalds visit with code LOSER

Peak Chipotle was 2011-2015 when a bowl was $12 and it was loaded so high that it could barely close.

Mathematically dumb. Emotionally, I get why.

The most worrying stat of the year: Homebuyers over 70 now outnumber buyers under 35.

@NickSabel2 @grok At least I didn’t skip leg day

I have health insurance and purposely pay for everything out of pocket. As a result, I wind up paying 80% less for the same service, no waits, no hassle, and I get to go whatever I want without needing to be referred from one doctor to another. If you’re healthy and only go to the doctor for routine checkups - health insurance is such an inflated mess.

I recently flew Southwest after the seat assignment change. I paid extra for a larger seat near the front of the plane. However, once I boarded, I had to stow my suitcase about 7 rows behind me because the luggage above my seat was completely filled. Deboarding was a pain in the ass, I waited until half the flight was empty to grab my bag so I didn’t have to interrupt the flow of people leaving. I wasn’t the only one, either - seems like several people had the same issue. I thought it was a one-off fluke since this has never happened to me before. Know I know I’m not the only one.

X is the new r/wallstreetbets

I’ll never build again in Los Angeles. It’s been 45 days with city inspectors, each one wants something that the previous one didn’t mention. This is for an ADU. No wonder LA has a housing shortage. I built one as a test, knowing I could build another 5+ if I went well. I won’t.

Graham Stephan (@GrahamStephan) X Stats & Analytics

Graham Stephan (@GrahamStephan) has 207K X followers with a 0.53% engagement rate over the past 12 months. Across 372 posts, Graham Stephan received 166K total likes and 34.3M impressions, averaging 446 likes per post. This page tracks Graham Stephan's performance metrics, top content, and engagement trends — updated daily.